It’s a safe bet that nobody in the sweet-goods or pastry sectors—nobody anywhere, for that matter—expected still to be contending with COVID-19 a full year and a half after lockdowns threw the baking industry, and life as we know it, into upheaval.

But here we are, approaching the end of 2021 with a scary new Delta variant on the rise and the pandemic’s costs continuing to mount.

The good news, though, is that those costs aren’t all sunk, and that the more we wrap our heads around this “new normal,” the better we understand the opportunities that its disruption hides.

After all, says Paul Baker, founder of St Pierre Groupe, Manchester, England, and international director for the St Pierre brand, “How people eat, when they eat, and the sense of occasion around each meal changed during COVID. It altered our circumstances.”

And as far as he’s concerned that’s a gift. “The growth potential for brands is huge,” Baker insists. “And for sweet baked goods in particular, it’s phenomenal.”

Crunching numbers

That promise of growth may paint a rosy picture for sweet goods and pastries going forward, but data from the preceding year calls to mind more of a crazy quilt—for whether toting up sales in the center store or perimeter, it’s hard to tease out a coherent narrative.

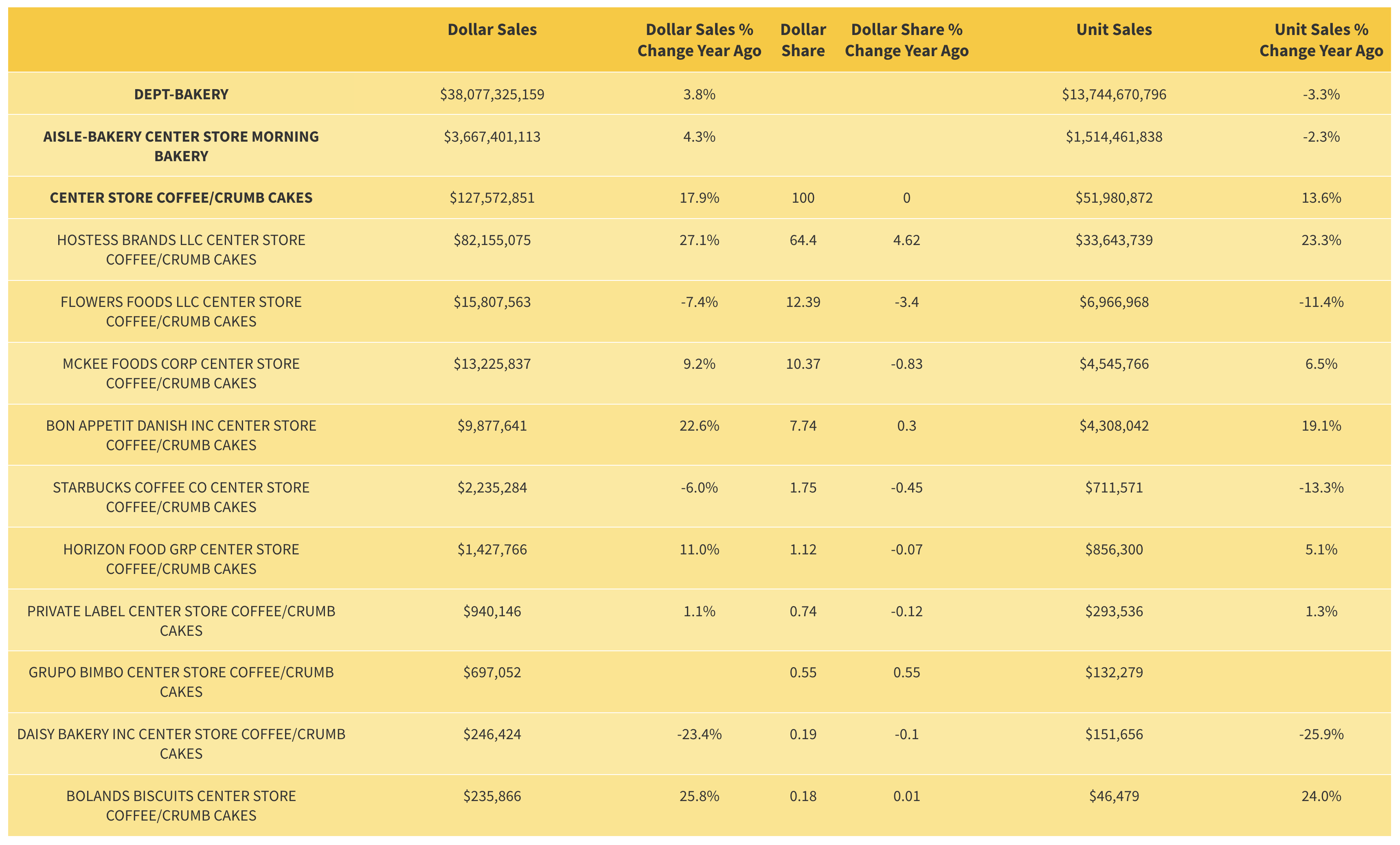

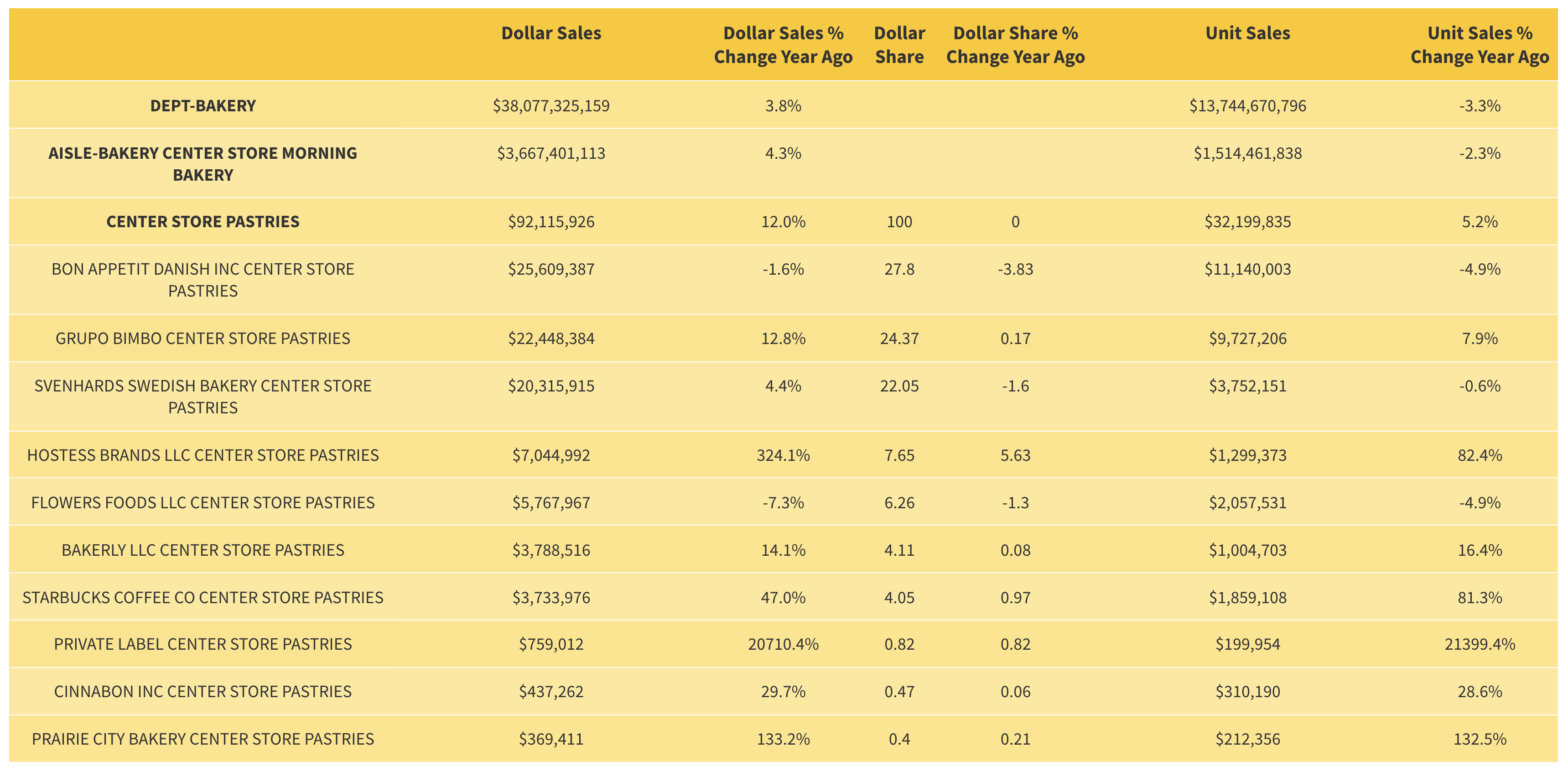

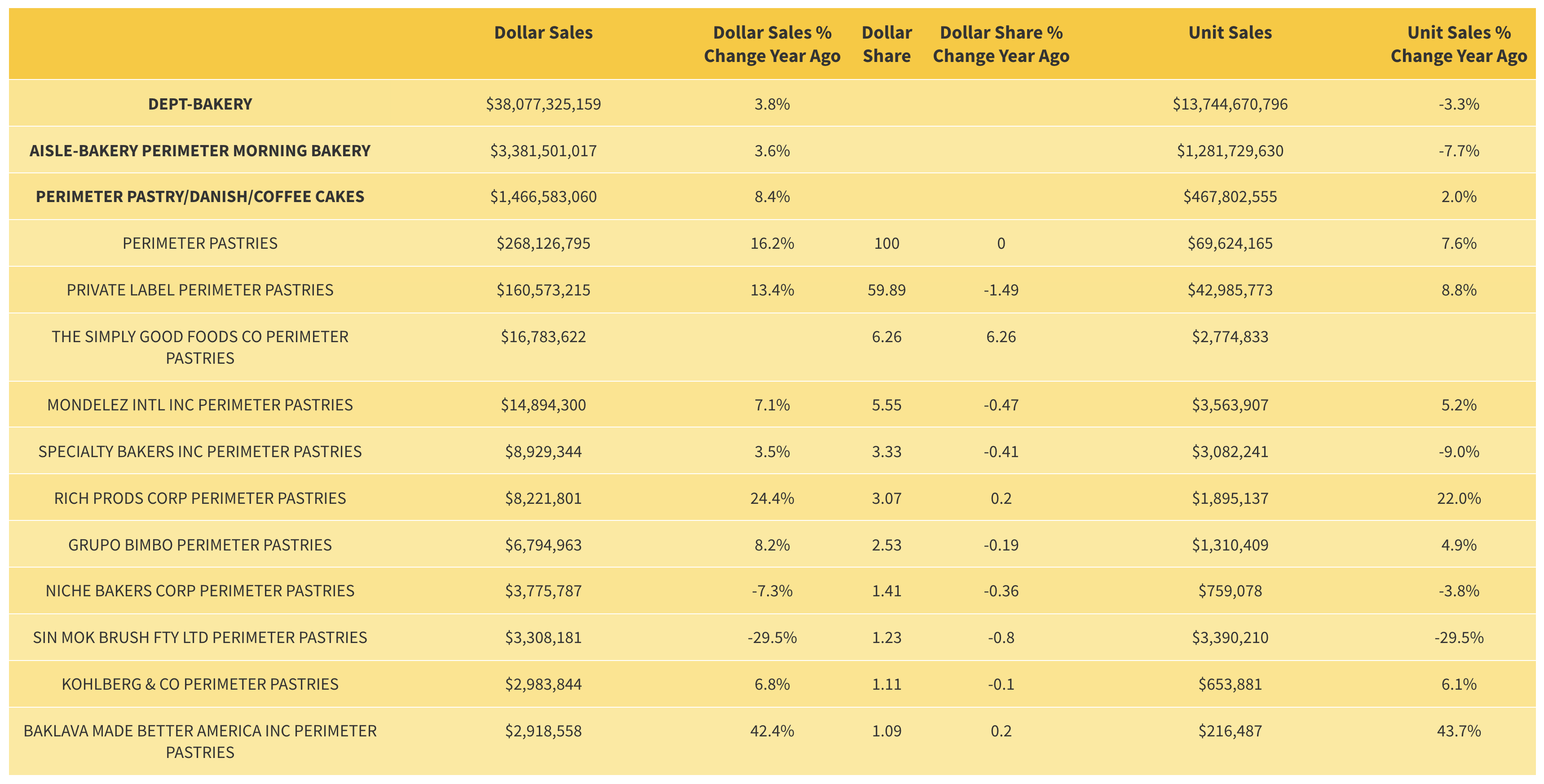

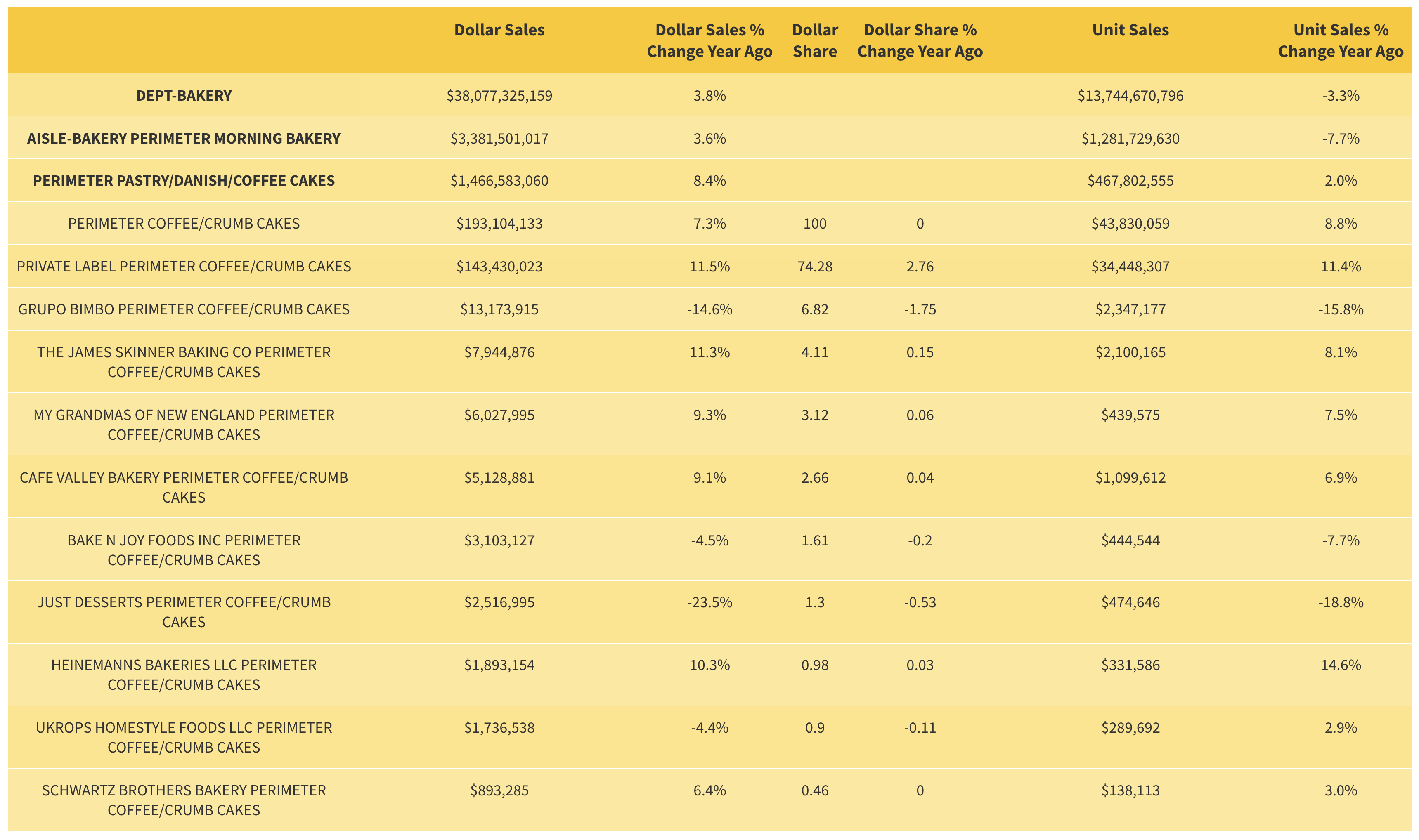

To wit, center-store dollar sales for the entire pastry, Danish, and coffee-cake category barely budged up 0.4 percent to $1.1 billion for the 52 weeks ending July 11, 2021, according to IRI, Chicago. Meanwhile, the category’s perimeter sales grew a more noticeable 8.4 percent to $1.5 billion.

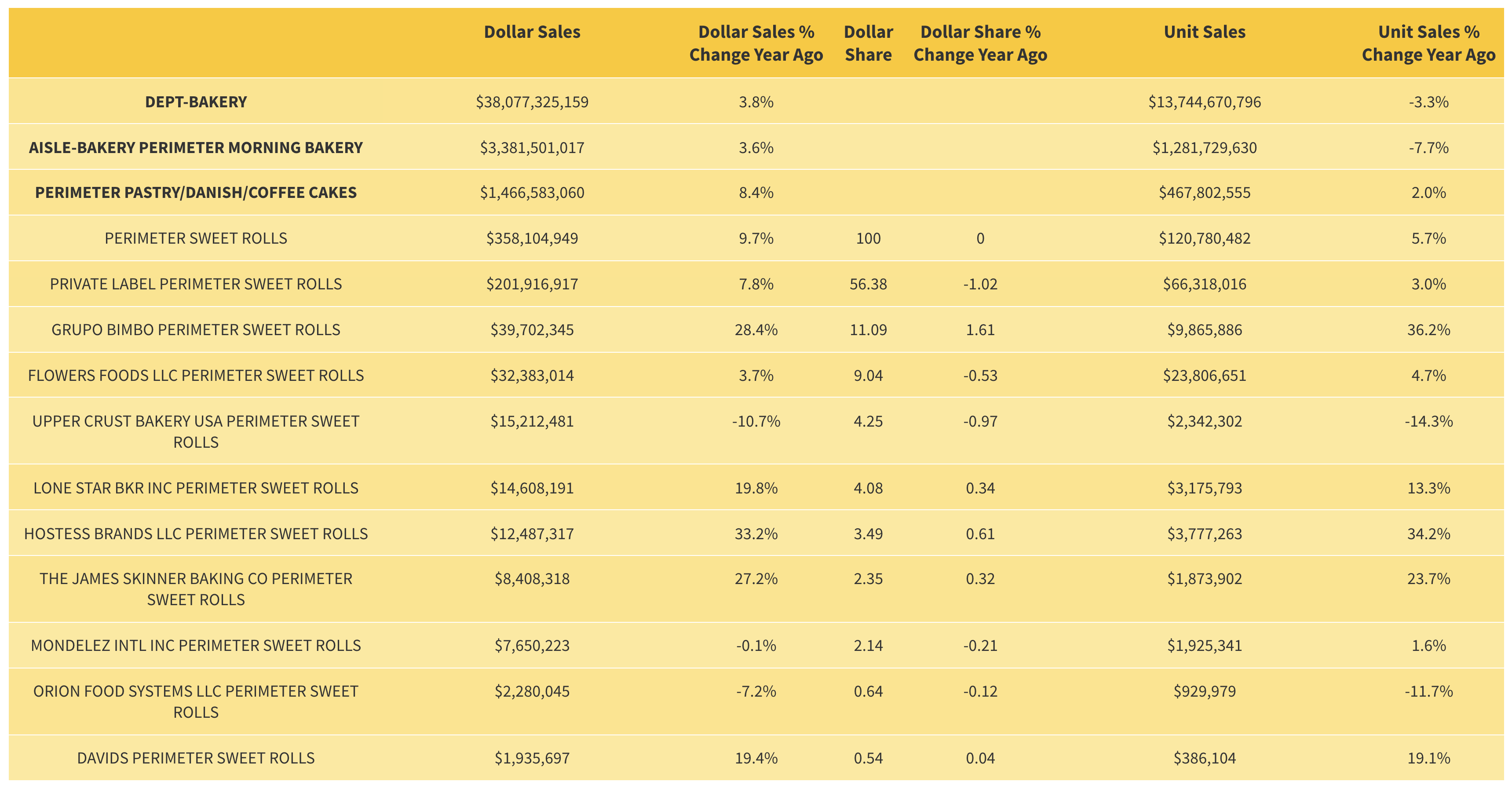

More granularly, perimeter sweet roll sales grew 9.7 percent to $358.1 million, with private-label perimeter offerings leading the pack at $201.9 million on growth of 7.8 percent. Sales of $39.7 million earned Grupo Bimbo second place among perimeter sweet rolls, with growth of 28.4 percent appearing substantially more impressive. Also impressive was growth of 27.2 percent—translating to dollar sales of $8.4 million—for The J. Skinner Baking Co.’s in-store bakery sweet rolls.

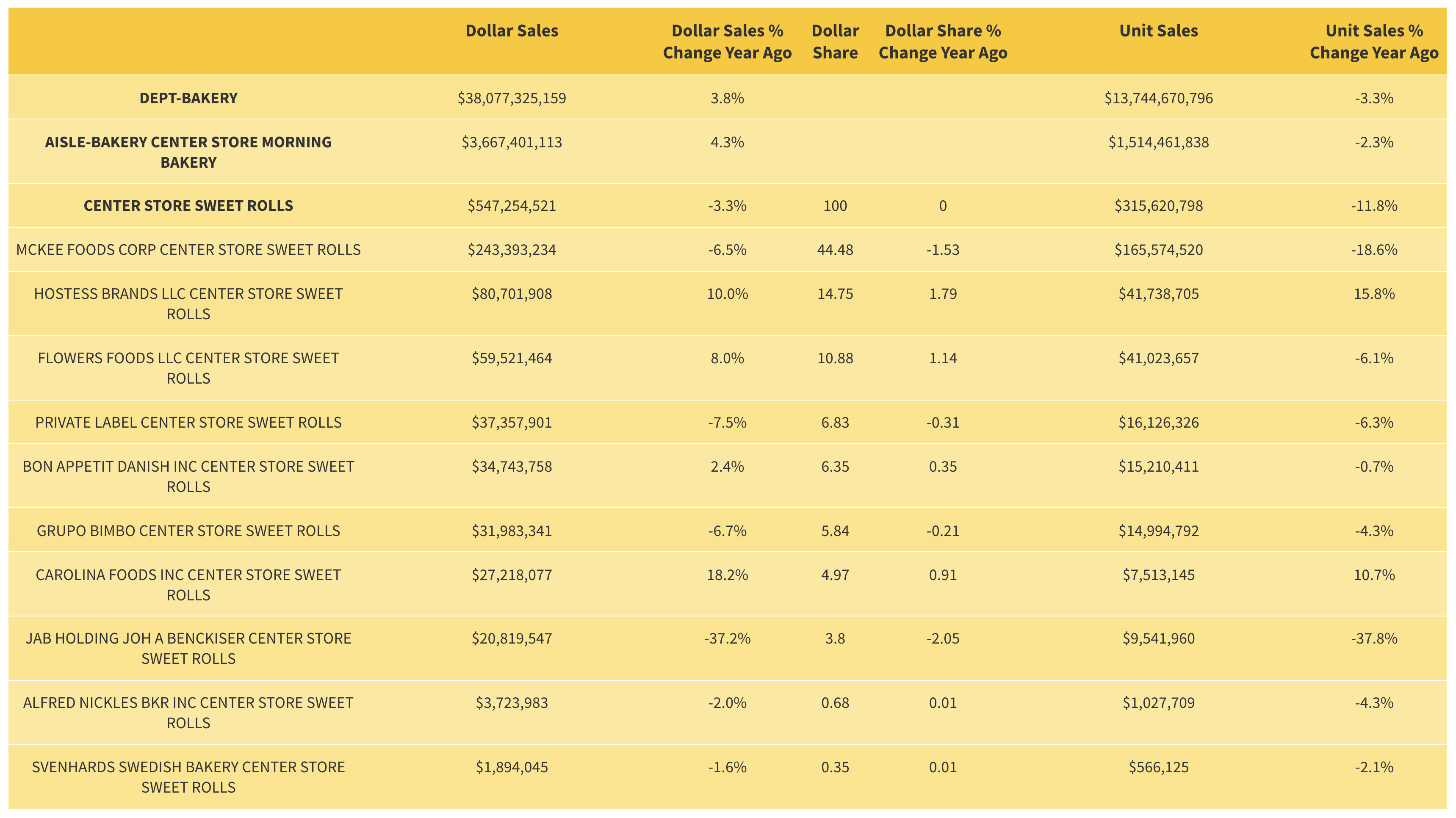

Center-store sweet-roll action was less dynamic, with sales contracting 3.3 percent to $547.3 million. Here, McKee Foods held the lead with sales of $243.4 million—a 6.5 percent decline from the previous year. Hostess Brands’ center-store sweet rolls grew their take 10.0 percent to reach $80.7 million in sales. And as for private label and Grupo Bimbo, they ranked fourth and fifth place, respectively, in center-store sweet roll sales, with the former banking $37.4 million (a decline of 7.5 percent) and the latter $32.0 (declining 6.7 percent).

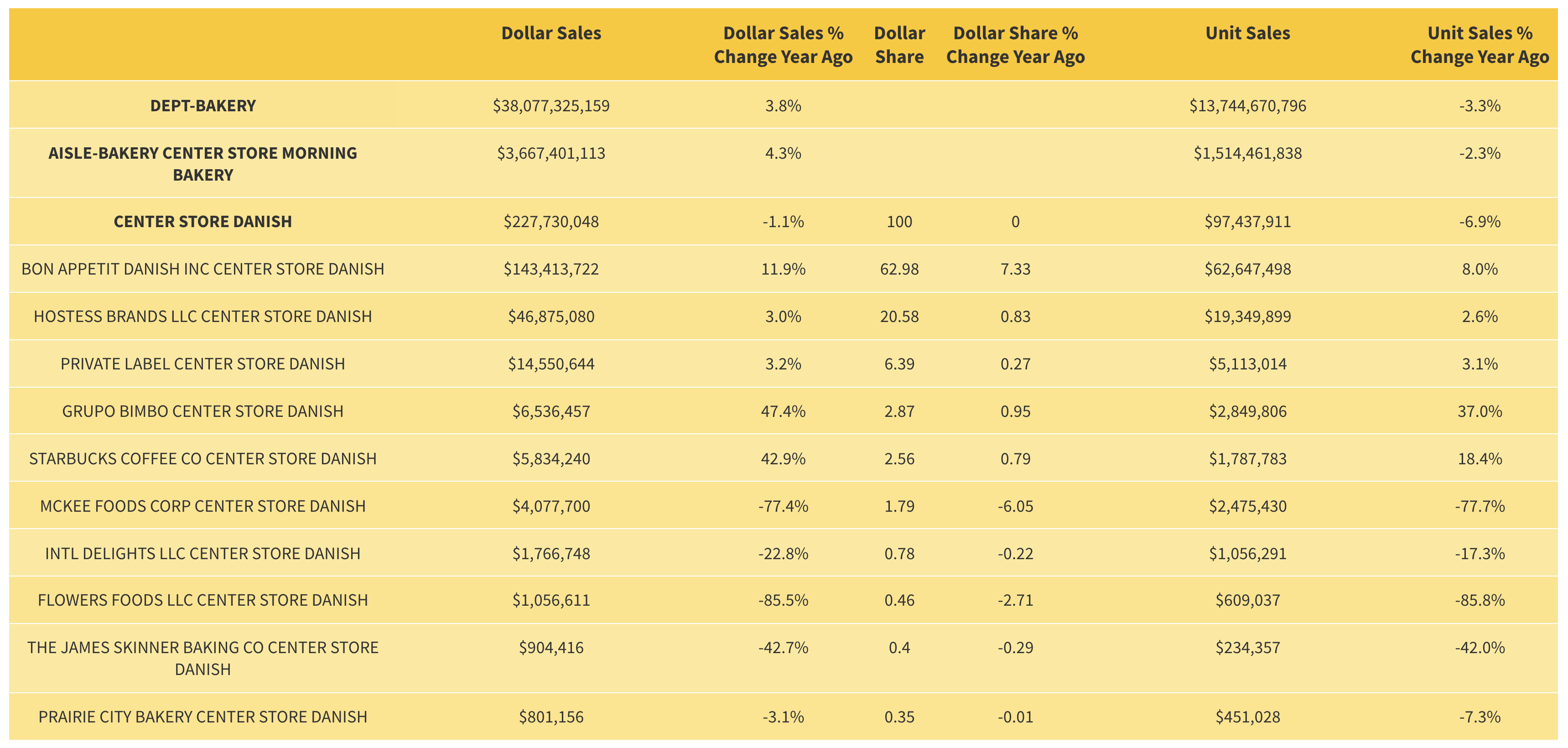

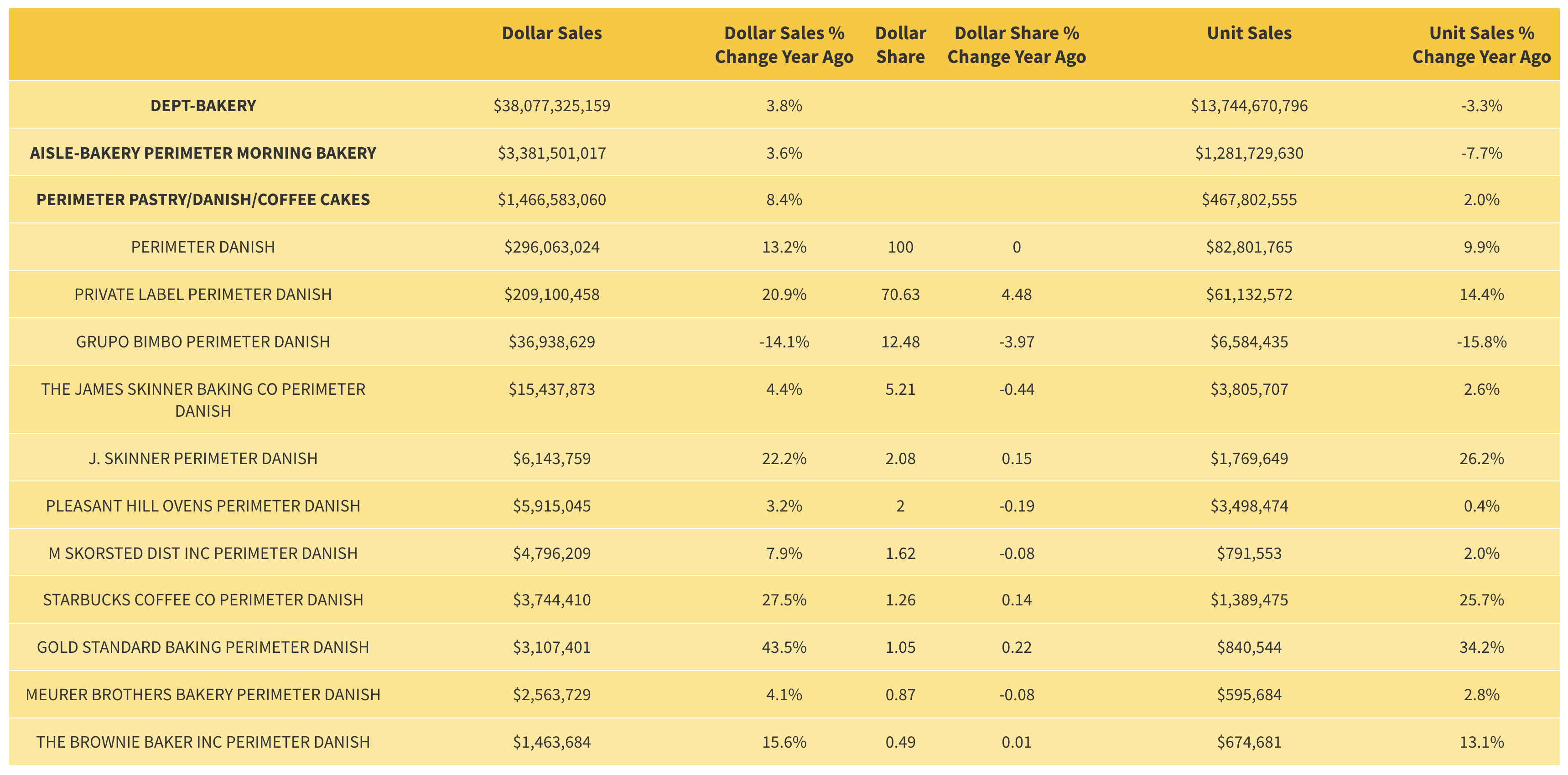

In the Danish space, perimeter sales rose 13.2 percent to $296.1 million, while center-store Danish offerings fared less favorably, declining 1.1 percent to $227.7 million. Private label ($209.1 million in sales and 20.9 percent growth), Grupo Bimbo ($36.9 million in sales, down 14.1 percent), and Starbucks Coffee Co. (sales of $3.7 million on 27.5 percent growth) took the top-three spots in the perimeter, while Hostess Brands ($46.9 million in sales, up 3.0 percent), private label ($14.6 million in sales, up 3.2 percent), and Grupo Bimbo (a mere $6.5 million in sales, but whopping growth of 47.4 percent) owned the Danish podium in the center aisles.

Worth noting is the contrasting perimeter and center-store performances of assorted and multi-pack pastry, Danish, and coffee cake formats. Legend has it that the larger pack sizes scored pandemic points with cooped-up families looking for bulk items to fill pantries fast. And indeed, the family-style formats thrived on stores’ outskirts, growing 22.1 percent on the perimeter to hit $1.1 million in sales. But the same formats took a 14.8 percent tumble in the store’s center, while still raking in $21.4 million.

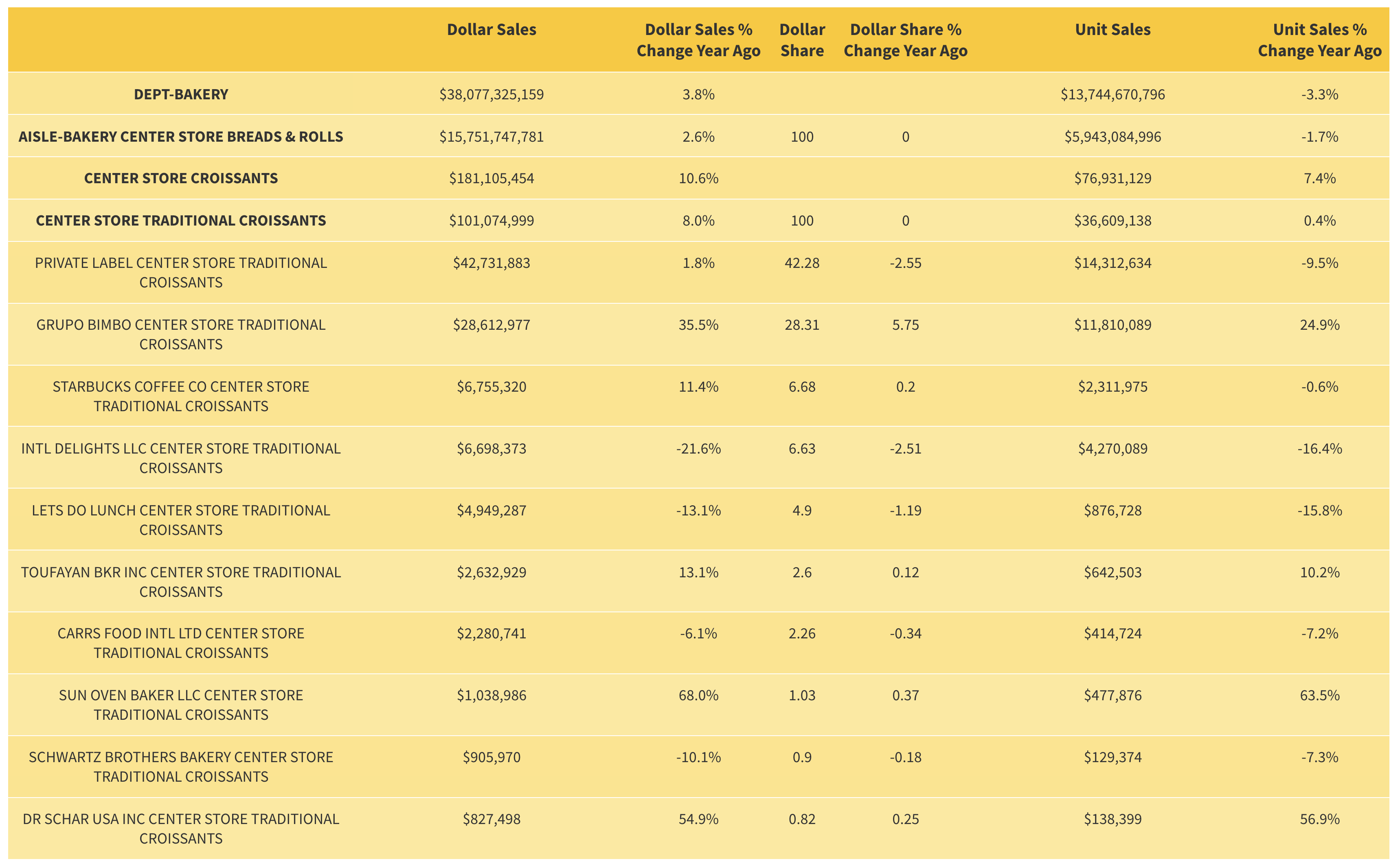

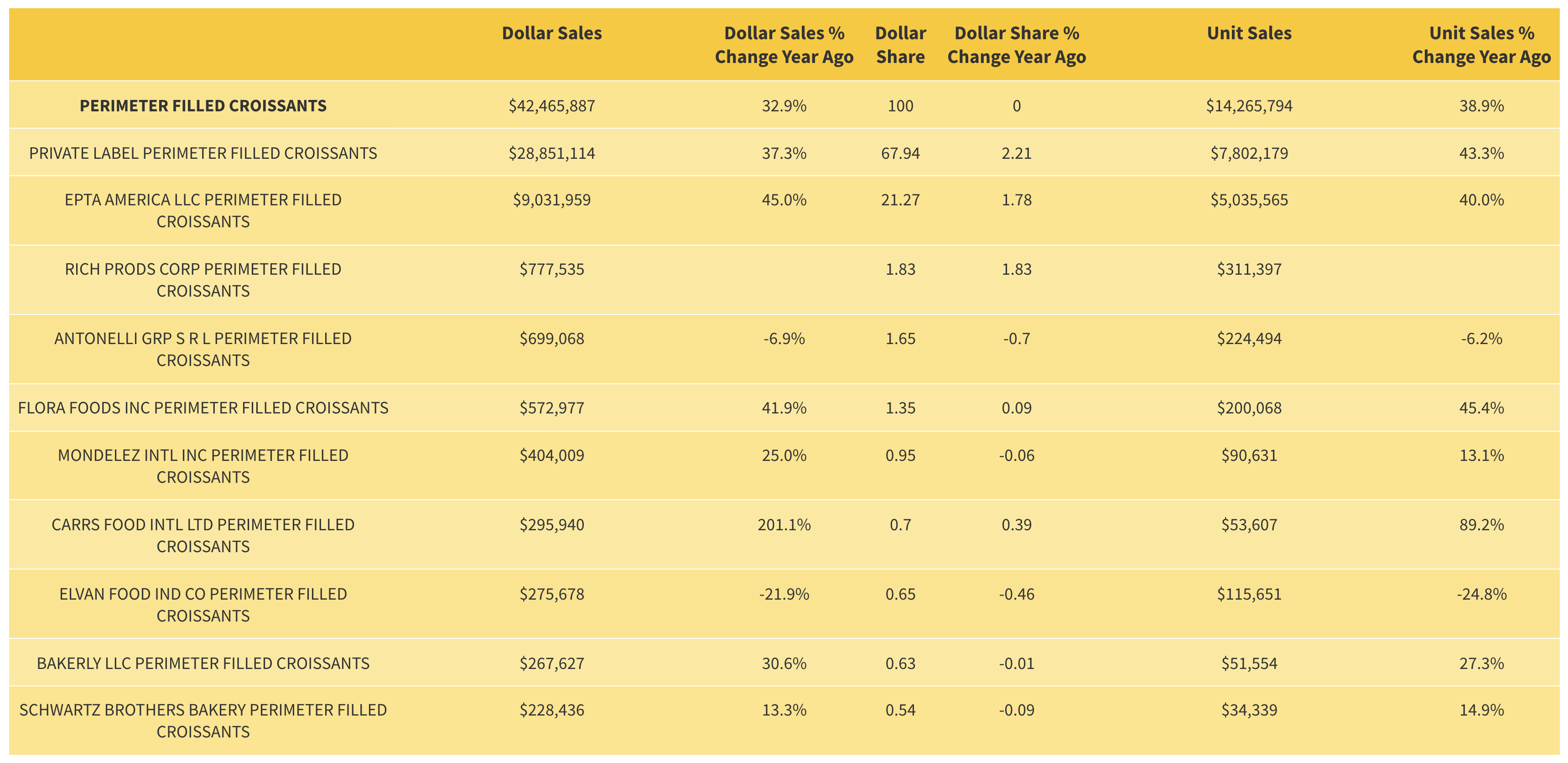

And finally: croissants. The buttery baked goods have a stronger presence on store perimeters, where they brought in $462.8 million and grew 16.5 percent over the 52 weeks measured. But in stores, the category topped out at $181.1 million overall on 10.6 percent growth. In both grocery regions, though, private-label brands seized the top spots among traditional croissants, with sales of $101.1 million and 8.0 percent growth in the center store, and $392.6 million in sales—up 16.4 percent--on the perimeter.

From edge to center

Any way you crunch the numbers, a key theme to emerge from the pandemic involved consumers’ shifting “hows” and “wheres” of shopping for sweet goods and pastries.

Those shifts were inevitable given the shifts retailers themselves had to make in the name of public safety, notes John Pimpo, marketing director, Parker Products, Fort Worth, TX. “Many in-store bakeries had to close during the early part of the pandemic,” he recalls, “and in some stores, they didn’t even reopen once delivery and pickup began trending.”

David Skinner, marketing manager, J. Skinner Baking Co., Omaha, NE, recalls a similar scenario. “The effects on bakery evolved quickly as the initial panic mentality had consumers seeking shelf-stable items,” he says. The upshot: “We watched center-store reap the benefits—especially center-store bakery.”

Interestingly, consumers discovered that center-store baked goods offered benefits beyond the pandemic, Baker contends. “It’s not a new idea,” he explains. “Extended-life products are very common in Europe, and as consumers looked to reduce their time in supermarkets amidst a global pandemic, they realized that products with an extended shelf life also carry environmental appeal because they lead to less food waste.”

A new bottom

On the supermarket’s perimeter, “We saw sales of bakery staples—breads, rolls, English muffins and tortillas—spike significantly,” Skinner continues. “But once the dust settled and consumers accepted the new normal, many perimeter staples fell back to their pre-pandemic sales.”

But sweet baked goods charted a different course. As Skinner recounts, “Something unique started happening with sweet baked goods in the perimeter.” To wit, “A big sales spike occurred,” he explains, “but instead of waning and eventually declining to pre-pandemic numbers, things jumped, creating a new bottom for the market. And from there, we’ve seen a slight upward trend in more unique breakfast-bakery sweet goods.”

Skinner theorizes that this happened because the pandemic introduced new consumers to in-store bakeries’ sweet goods and pastries. And as it turned out, the items on offer proved impressive enough to keep those shoppers coming back.

Evolving pastry platforms

The pandemic also kept shoppers—or at least, the more digitally-inclined among them—coming back to their phones and laptops to order sweet pastries online. And retailers with an omnichannel presence were at the ready to serve them.

Case in point, Skinner says: “Retailers with sophisticated portals for digital shopping were able to leverage their investment in algorithms that display higher-profit-margin items—including sweet baked goods—into strong sales.”

Brands with established delivery partners also found themselves equipped to pivot.

Such was the case with Cinnabon, says Kristen Hartman, category president, specialty brands, Focus Brands, Atlanta. “As many consumers turned to at-home dining over the past year, we were able to expand our presence on third-party delivery platforms to let our fans order their favorite treats and enjoy them at home,” she says.

Cinnabon saw its domestic e-commerce business grow, too, thanks to a 2019 deal it inked with Harry & David making the retailer’s website the sole online outlet for purchasing Cinnabon gift boxes. As Hartman notes, “During the pandemic many consumers looked for ways to gift their loved ones—or themselves—something sweet.”

Disoriented dayparts

Many of those consumers likely found themselves—or their loved ones—digging into their gifts at random times throughout often-unstructured days. The reason: The pandemic threw daily routines, including meal times, out the window.

“And with dayparts blurring and consumers snacking more at home throughout the day,” Pimpo adds, “the traditional morning meal suffered.” In fact, he’s seen data indicating that consumers enjoyed pastry products less as breakfast items than as desserts or snacks.

Yet Pimpo sees potential in this daypart disruption. “Is the opportunity for the sweet-pastry market in the morning or at dessert?” he asks. “And will consumers grab that extra Danish with their morning coffee, or will a unique baked good make it to the dessert plate?”

Either way, there’s room for growth—especially for sweet baked goods that can wear many hats and meet many needs. “Consumers are opting for products that offer multiple uses, or greater versatility in the purposes they serve,” Baker says. “Savvy brands and producers will highlight versatility in their offering to make the most of this opportunity.”

All in the family—or less is more?

As mentioned earlier, the pandemic also goosed demand for multi-serving family packs.

That was certainly the case with Cinnabon’s CinnaPacks, Hartman says. The boxes of six, nine, 12, and 15 rolls “have always been a significant part of our sales mix,” she notes. “But we saw it grow during the pandemic both in our bakeries and through third-party delivery and ecommerce, as consumers needed larger quantities to feed homebound families.”

That said, “We still saw guests ordering single servings of our baked goods and beverages,” she goes on. And the brand’s conspicuously petite MiniBons and BonBites—the former weighing in at slightly smaller than the original roll and the latter smaller still—are popular with consumers who lean toward a less-is-more mindset.

And those consumers are out there, Baker says. St Pierre’s mini croissants are “the biggest-selling product in our sweet-treats and pastry range,” he notes, and though the minis are sold in packs of 10, he says, “They still let shoppers enjoy smaller portions.”

Craving comfort

The fact that those croissants are doing such brisk business reflects another trend that Baker noticed during the pandemic: a return to familiar favorites.

“Nostalgic baked goods like croissants provide comfort during stressful times,” he points out, “and an increased yearning for nostalgia in food was notable throughout and after the pandemic.”

Pimpo agrees: “The pastry category thrives on comfort, and this is exactly what the world needs as we ease back into regular life.” No wonder flavors like chocolate, vanilla and caramel maintain their lead, he says, with similarly rich profiles like brown butter and salted caramel also gaining ground.

“Yet traditional comfort foods are making their way into pastry sections along with mashups and new creations, too,” Pimpo continues. “New iterations of s’mores, cannoli, churros, and the like are all in development as innovative options.”

Indeed, Cinnabon will reintroduce for a limited time its Cookie BonBites—“a delicious mashup of our signature bite-sized cinnamon roll inside a warm, melty chocolate-chip cookie,” Hartman says.

International influence

And Cinnabon’s international menus always take their cues from products and flavors popular locally, says James Reynolds, vice president of marketing, Focus Brands International. An example is the ChocoBon—the brand’s classic cinnamon roll stuffed with chocolate and topped with its signature cream-cheese frosting plus a chocolate drizzle.

“It’s one of our most popular items offered in different varieties,” Reynolds says. “And we continue seeing flavorful innovation around our classic rolls and MiniBons across the world, including lemon-cheesecake and salted-caramel cheesecake MiniBons in Australia.”

As a leading manufacturer of brioche and croissant, St Pierre Groupe also celebrates international influence, Baker says—and that influence is apparent in the brand’s chocolate and hazelnut rolled crepes. “Crepes are a French classic that’s perfect for breakfast, lunchboxes and afternoon snacking,” Baker notes, “and our authentic lace-thin crepes are a product we’re proud of.”

“The waffle category is growing, as well,” Baker adds—“up across the board by 141 percent year on year. Our brioche waffles with butter are up 16 percent, and there’s still opportunity to drive distribution.”

On the wilder side

Baker credits open-minded—and often young—consumers with driving demand for global pastries and flavor profiles.

“Millennials are more exploratory in their tastes and account for a huge portion of the food market,” he notes. “Thanks to them, the idea that certain flavors or foods ‘aren’t for me’ is fading. New flavors are easier to try and consumers are driving demand for weird, wonderful and whimsical combinations.”

But lest anyone get ahead of their skis, Skinner cautions that “flavor trends in in-store bakery can be difficult to decipher.”

Before COVID-19, Skinner says, “Most could get away with traditional apple, cheese, raspberry, chocolate, etc.” And though some manufacturers pushed flavor boundaries, he continues, “The in-store bakery consumer never seemed terribly interested.”

But now that new shoppers are discovering in-store bakery selections, Skinner’s finding that “they’re not settling for your everyday varieties”—making now “an unprecedented time to cater to these new segments,” he says. “It’s up to in-store bakeries and their suppliers to respond and maintain interest.”

That doesn’t mean pulling out all the stops; rather, Skinner suggests that bakeries “focus on improving product features and benefits. Hot buttons like sustainable packaging and cleaner ingredient decks will improve consumer perception of these products.”

Keep it clean

However, Skinner maintains, “At the end of the day, the in-store bakery is a hedonic department.” And consumers recalibrate their standards when they enter it.

“There’s a sliding scale of ‘cleanliness’ at play,” he says. “On one end you have products with ingredients you can’t pronounce, and on the other you have the ultimate in clean and organic. Depending on your target consumer, there are several sweet spots on that scale you can meet.”

Pimpo agrees. Clean labeling “comes down more to brand positioning than to anything else,” he believes. “Whether you’re a restaurant chain serving breakfast pastries or an individually packaged Danish in a C-store, if your position is that you’re ‘healthy,’ your ingredient deck should match.”

Ultimately, though, experts advise keeping the consumer’s experience in mind. Pastries, Baker insists, are about “an experience—and in this category, attributes of great quality and taste will outweigh health arguments time and time again.”